Tax Season 2020 Updates and Helpful Resources

Posted on April 15th, 2020 by Connor Blay

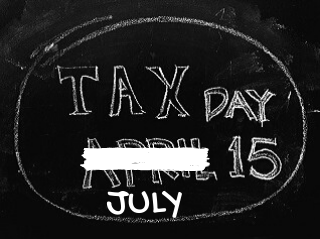

Happy Tax Day! Typically, today would be the day that we remind you all to make sure to mail any last-minute tax return documents to the IRS before the day ends. The post offices would be a flood of people, tax documents in hand, trying to get their documents time-stamped with today’s date before mailing them to the IRS so their returns wouldn’t be marked late. Needless to say, this year is obviously looking a little different than years past. Due to the COVID-19 pandemic, the IRS has pushed back the federal tax return deadline to July 15th meaning that all international students with federal tax return obligations will now have until then to complete and mail in their tax return documents to the IRS. Additionally, state deadlines have been pushed back but state requirements and deadlines vary. As of April 15th, 2020, these are each of the states’ tax return requirements and deadlines*:

States that have no income tax and aren’t required to file

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

States that have an income tax deadline of July 15th

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Utah

- Vermont

- West Virginia

States with different income tax deadlines beyond April 15th

- Hawaii (July 20)

- Idaho (June 15)

- Iowa (July 31)

- Mississippi (May 15)

- New Hampshire (June 15)

- Virginia (May 1 to file; June 1 to pay)

While you now have more time to complete and file tax returns we still encourage you to do them as soon as possible since you might have a refund coming your way. To get started this tax season you can turn to the resources in our Student Tax Return section:

Tax Form 8843 Wizard

The Tax Form 8843 Wizard is an excellent tool to help international students complete the required Form 8843. Simply enter your information into the Wizard and it will produce a populated form for you! You’ll need to be sure to have the following documents in front of you before you begin:

- Passport

- US Entry and Exit Dates

- Visa/immigration status information, including Form I-94 Arrival-Departure Record, Form DS-2019 (for J visa holders) or Form I-20 (for F visa holders)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

You should also be sure to use a browser other than Internet Explorer and disable all pop-up blockers.

Tips and Important Info

Taxes can be complicated and it’s likely that you could need some help, especially if you are filing for the first time. Within the Student Tax Return section, you can find tips and important information throughout these pages:

Sprintax

If you have any unanswered questions or need additional assistance regarding tax returns, we recommend that you use Sprintax, a nonresident tax preparation service. Sprintax services were designed to help international students, scholars, teachers, and researchers in the US on F, J, M, and Q visas with the tax return process. It’s easy-to-use, hassle-free and affordable!

Again, we encourage you to get your tax returns completed as soon as possible. If you are eligible to receive a return, the quicker you file, the quicker you get your return. But most importantly, stay safe and healthy out there everyone!

*These deadlines are still subject to change based on how COVID-19 continues to impact us. You should stay up-to-date by visiting your state’s website.